Live life with no regrets. The rules for tax mitigation were written for Corporate America. Let’s look at a few corporations in America. Our forefathers set forth corporate law here’s an example of a few corporations that a lot of individuals are not aware of

The United States of America is a corporation, Federal reserve is a corporation and IRS.

FICA tax rules have remained consistent.

On the right hand side of this page you’ll see

The word FICA

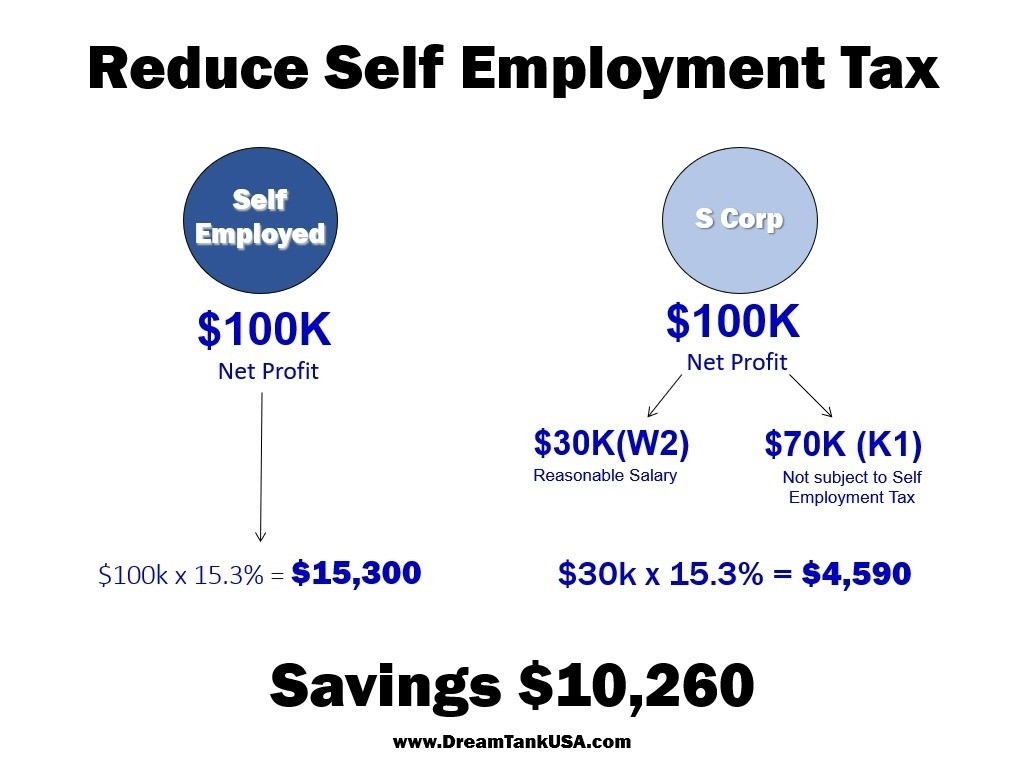

The Information gives you a breakdown on self-employment

TAX.

Part of the acronym T.A.P

One of the keys that unlocks the corporate lifestyle is to follow the rules and guidelines the IRS set this will help you to stay in compliant.

While keeping more of your hard-earned money. There’s tax preparers and tax planners, plan for your future with a qualified Corporate CPA.

Learn how to Live the Corporate Lifestyle T.A.P. into they advantages and resources and the power of the Corporate World!

Tax savings, Asset protection, privacy the acronym T.A.P.

A lot of people think there are two sets of rules, the rules for those who are successful and the rules for everyone else. But in reality the rules are the same for everyone. The only difference is that successful people use the rules to their advantage, while everyone else does not that is the fundamental difference. One way in which successful people use the rules of money to their advantage is through corporations.

© Corporate Connecting Point 2016-2025|Powered by Triforce Digital Marketing Agency | Privacy Policy | Disclaimer | Terms & Conditions | Sitemap

© Corporate Connecting Point 2016-2024 | Powered by Triforce Digital Marketing Agency | Privacy Policy | Disclaimer | Terms & Conditions | Sitemap